A Teen’s Guide to Smart Shopping

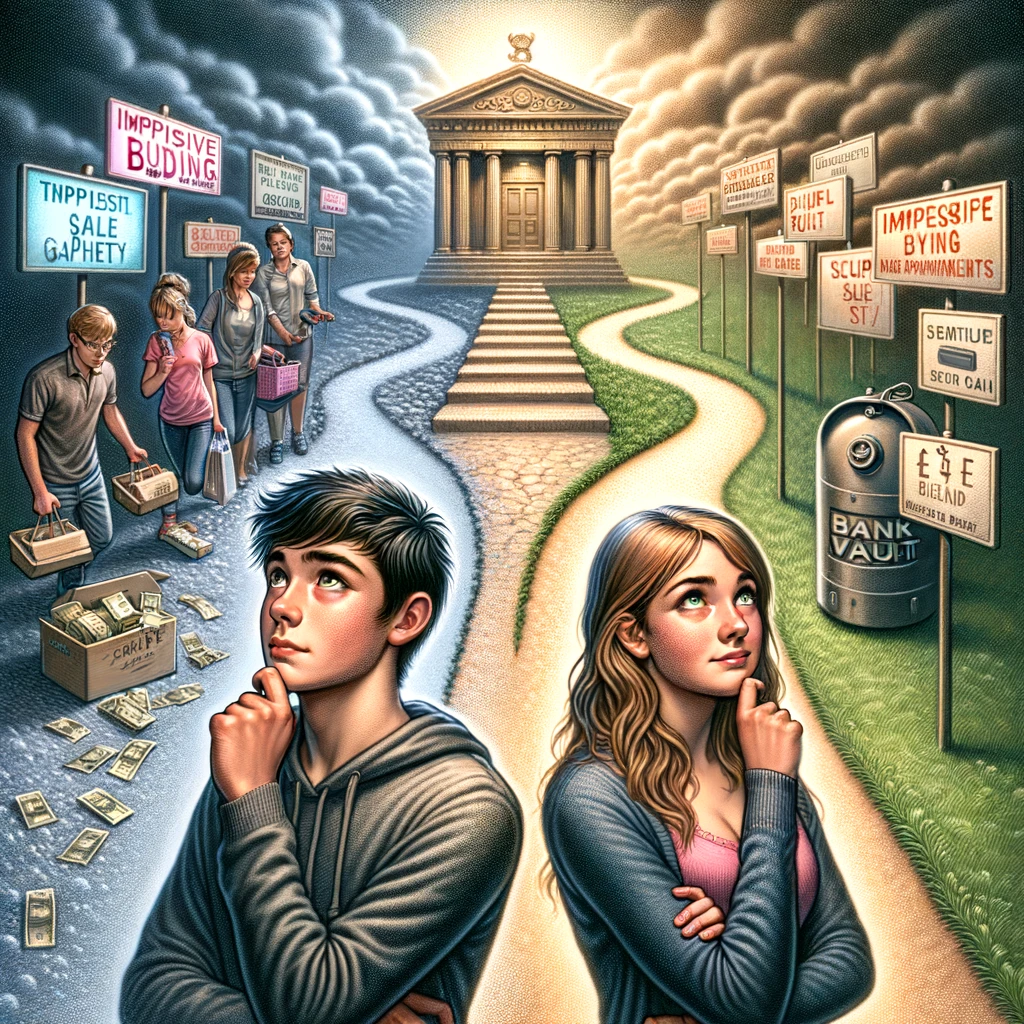

In today’s world, where every click brings up a new ad or a flashy “limited-time offer,” it’s easy to fall into the “buy it now!” trap. These traps are everywhere, from social media feeds to email inboxes, tempting you with the latest gadgets, fashion, and more. But fear not! With a bit of know-how and self-control, you can navigate these waters like a pro. Here’s how:

Understand the Trap

First off, know what you’re up against. These traps are designed to make you feel like you’re getting a deal that’s too good to pass up or that you have to buy something right now to be happy or fit in. Remember, these are marketing strategies aimed at making you spend impulsively.

Tips to Dodge the Traps

- Pause and Reflect: Feel the urge to click “buy” on that must-have item? Take a moment to ask yourself, “Do I really need this? Will I still use it a month from now?” Often, taking time to reflect can cool down the impulse.

- Set a Budget: Know how much you can afford to spend on non-essentials each month. Keeping a budget helps you prioritize your spending on things that actually matter to you.

- Wait It Out: Many impulse buys are influenced by the fear of missing out (FOMO). Give it 24-48 hours before making a purchase. If you still think it’s worth it after some time has passed, then it might be a good buy.

- Research Before You Buy: Got your eye on something? Do a quick search to compare prices and check reviews. Sometimes, the urgency to buy now blinds us to better deals or warns us about poor quality.

- Unsubscribe and Unfollow: Reduce temptation by unsubscribing from marketing emails and unfollowing brands that constantly push you to buy. Out of sight, out of mind.

- Recognize Emotional Spending: Buying things can give a temporary happiness boost, but it’s fleeting. Recognize when you’re shopping to fill an emotional void and find healthier ways to cope, like talking to a friend or engaging in a hobby.

- Save for What Really Matters: Instead of spending on every “deal,” save your money for something you truly want or need. Having a savings goal can make it easier to pass up unnecessary purchases.

- Use Technology Wisely: There are apps and browser extensions that can help you manage your spending, compare prices, and even block certain websites if you find them too tempting.

The Bigger Picture

Learning to dodge these “buy it now!” traps isn’t just about saving money—it’s about taking control of your financial future and making conscious decisions about what’s truly important to you. By developing smart shopping habits now, you’re setting yourself up for a lifetime of financial savvy and independence.

Remember, the goal isn’t to never treat yourself but to do so in a way that doesn’t compromise your financial health or long-term happiness. Happy (and smart) shopping!