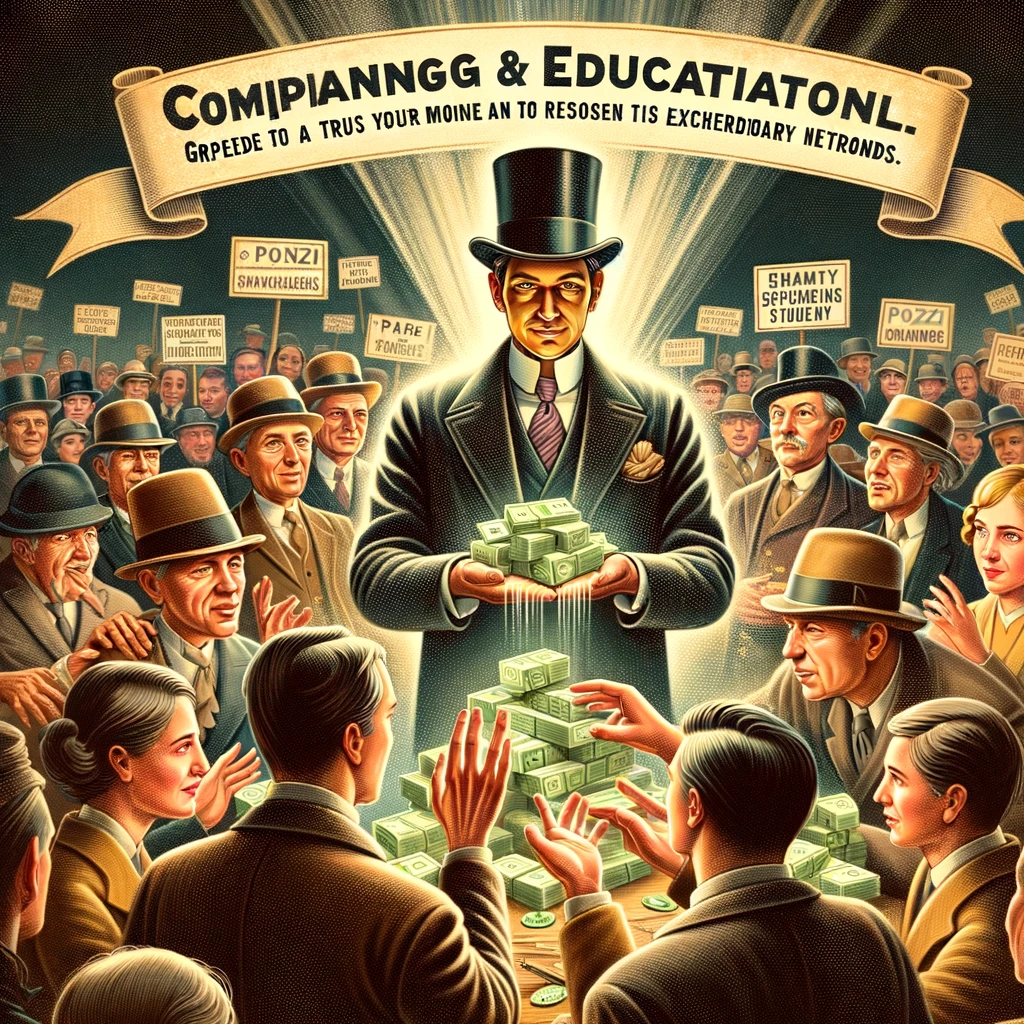

A Lesson in Greed and Trust

In the world of financial scams, few are as infamous or as intriguing as the Ponzi scheme. Named after Charles Ponzi, who catapulted the strategy to notoriety in the early 20th century, the Ponzi scheme is a stark reminder of the old adage: “If it seems too good to be true, it probably is.” Let’s dive into this fascinating story, unpack the mechanics of the scam, and explore what lessons teenagers today can learn from it.

1. Who Was Charles Ponzi?

Charles Ponzi was an Italian immigrant who moved to the United States in search of the American dream. In the 1920s, Ponzi stumbled upon an investment opportunity he believed could make him rich. His plan involved buying international postal reply coupons in countries with weaker economies and redeeming them in the US for a higher number of stamps, which could then be sold for a profit. Though the idea had potential, the profit margins were too small for the scale Ponzi envisioned.

2. The Birth of the Ponzi Scheme

Undeterred, Ponzi began to promise investors a 50% return on their investment within 45 days, or a 100% return within 90 days. The catch? Instead of making money through any legitimate business activities, Ponzi paid earlier investors with the money contributed by newer investors. Initially, the scheme worked. Word of mouth about the incredible returns spread, and investment poured in from all over, allowing Ponzi to repay his initial investors as promised, further fueling the scam’s legitimacy.

3. The Scheme Unravels

Like all Ponzi schemes, the bubble eventually burst. The returns promised by Ponzi required an ever-increasing flow of new investments to sustain. When the influx of new investors slowed, Ponzi could no longer meet his obligations, and the scheme collapsed. Thousands of investors were left penniless, and Ponzi was arrested and charged with multiple counts of fraud.

4. Lessons for Teens

The Ponzi scheme is more than just a historical cautionary tale; it’s a lesson in financial literacy that remains relevant today. Here’s what teens can learn from it:

- Too Good to Be True: Always be wary of investments that promise unusually high returns with little or no risk. Legitimate investments carry some level of risk and rarely offer quick riches.

- Research Is Key: Before investing your money, do your homework. Investigate the investment opportunity and the person or company behind it. If information is hard to come by or doesn’t check out, it’s a red flag.

- Understand Where Your Money Is Going: Know how your investment will generate returns. In Ponzi’s case, investors were in the dark about the actual mechanism of profit.

- The Importance of Regulation: Financial regulators and laws exist to protect investors. Investing through regulated channels can provide a layer of security.

5. Conclusion

The Ponzi scheme is a testament to the importance of scepticism and due diligence in the financial world. By understanding the signs of financial scams and the value of informed investing, teens can protect themselves from falling victim to schemes that prey on greed and gullibility. Remember, in investing and in life, there are no shortcuts to wealth—wisdom, patience, and integrity are your best assets.